3Q results were released after market this morning that just missed expectations in terms of revenue and same store sales, but it was not by much. Shares were trading down ~4% after hours.

- Revenue of $US2.79bn for the quarter, a shade below consensus of $US2.82bn.

- Same Store Sales+6% YoY, slightly below consensus of 6.3%

- Earnings Per Share (EPS) beat, coming in at 27cps vs 25cps expected.

- They reiterated guidance for same store sales growth to be up mid to high single digits, though their guidance for new stores (315-345) trailed expectations for 358.

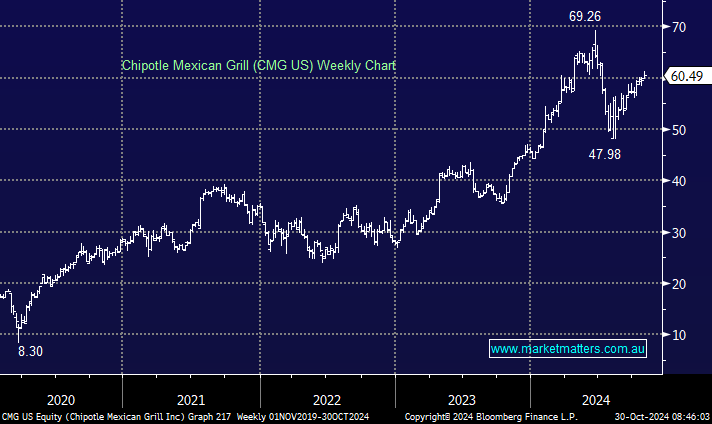

The stock is up over 30% this year, so it’s been a good run and the sell-off post these results is mostly about their track record of ‘beats’ and therefore market positioning. The business is going incredibly well, and this is shown through some important metrics; Operating margins at the group level of 16.9%, up from 16% and ahead of expectations at 15.7% while restaurant level operating margins remained solid at 25.5%. Average restaurant sales of $US3.18m were up +7.1% YoY and ahead of expectations of $US3.15m.

- We thought this was a solid result, and while a very slight miss on some aspects, the underlying operating metrics across the group still look great.