The Mexican fast-food chain met in terms of 2Q numbers however they lowered guidance for the second time this year, and the stock was hit ~8% after hours.

- 2Q revenue of $US3.1 billion, inline with expectations.

- Adjusted EPS 33c vs. 34c y/y, relative to consensus of 33c

- Restaurants operational at period end 3,839, estimate 3,848

- Average restaurant sales $US3.14 million, estimate $US3.19 million

Comparable sales though were down -4% which was the issue. While sales were expected to be down 2.9%, the momentum looks weak and the growth is being driven by new restaurant openings, rather than growth in their existing stores. They do expect an improvement here over the full year, with comparable restaurant sales to be “about flat,” but they had previously guided for growth in the low-single-digit range. Consensus had 0.75% pencilled in which will now be revised lower.

They also reaffirmed expectations to open between 315 and 345 new restaurants in 2025, with more than 80% including a Chipotlane – a positive but not enough for a stock on ~40x.

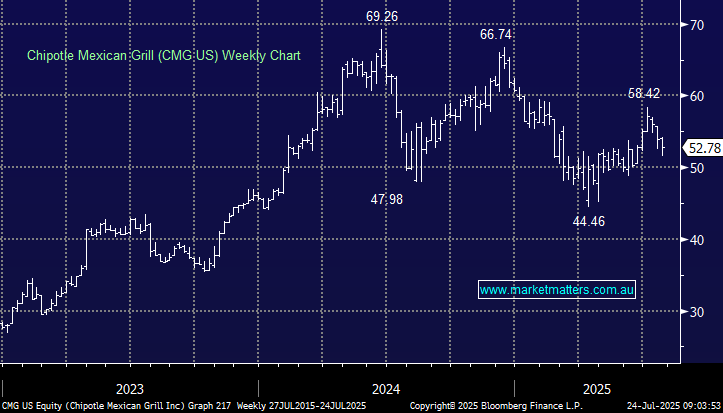

- Overall, softer guidance but not a disaster, and they did speak to momentum turning more positive towards the end of the period. We think the stock will now be in a holding pattern for the next 3-6 months.