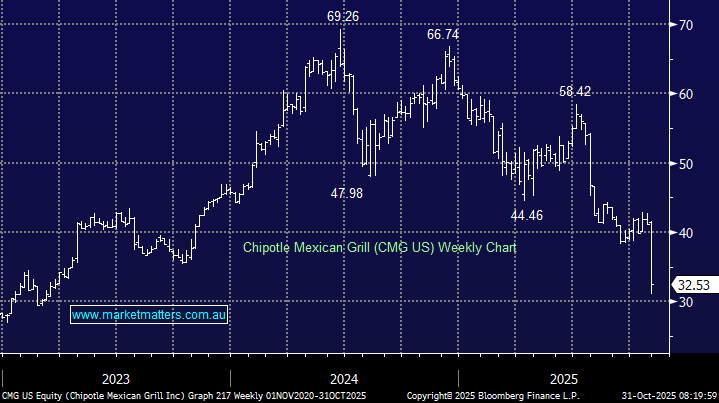

An underwhelming 3Q25 results out for the Mexican fast-food chain overnight, with the stock falling ~18% – it’s worst single day move since 2012, after the company cut its same-store sales outlook for the third time this year. The downgrade reflects weakening customer traffic and persistent margin pressure from higher wages and input costs, outweighing otherwise solid execution on store growth.

- 3Q Revenue of $US3.0bn (vs. $US3.02bn expected),

- Underlying EPS US29c, inline with expectations

- Same store sales rose just +0.3% (vs. +1.0% expected)

- Restaurant-level margins slipped to 24.5% (vs. 25.5% est.).

- Average restaurant sales $US3.13m ($US3.12m est.).

Management now expects low single-digit declines in FY25 comps (previously flat), implying a soft finish to the year. Store growth remains on track, with 84 new restaurants opened during the quarter, taking the total to 3916. They have maintained guidance for openings in FY26 of 350-370, though no real growth at each store and margin pressure has the market concerned.

CMG is a growth company, now back trading at 25x relative to its 5-year average of 45x. While the earnings multiple has compressed, it’s still priced for a pickup, and the lack of growth at the store level is concerning – new store openings are the only way they are generating top line growth.

- A disappointing update from CMG, with our position now mildly underwater. They do have a credible path to turn around, but they need some more supportive macro dynamics to help.