Another phenomenal quarterly result from the fast-growing Mexican eatery was reported last week, pushing shares to yet another all-time high. Same-store sales (SSS) growth of 7.0% was a standout (about 2% ahead of consensus) driven by more sales at higher prices. To put this into context, Dominos (DMP) ran at 2.8% for Q4 in their US business but sub 2% more broadly. Q1 revenue was up 14% YoY at $2.7bn, while margins were exceptional both at the restaurant level (27.4%) and the broader operational level. This drove a decent beat at the profit line, with earnings per share (EPS) of $13.37 more than 14% ahead of consensus.

The outlook looks equally attractive. Growth at existing stores is complemented by another 285-315 new stores set to open in 2024, and that number will grow further in 2025. While the stock was very strong leading into this result, they continue to deliver operationally, customers love them, and they are prepared to spend more money at more locations. What’s not to like?

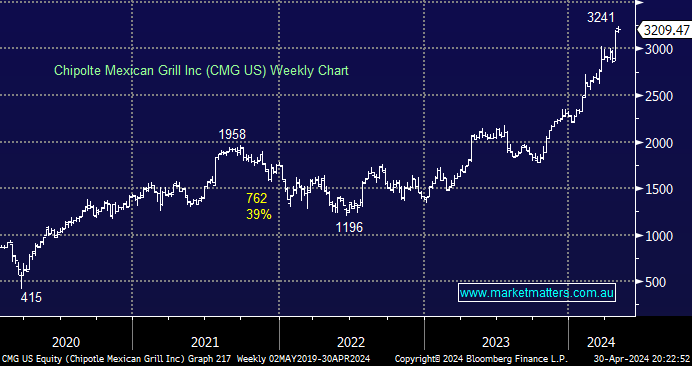

- We own CMG directly in the International Equities Portfolio and indirectly through our holding in Pershing Square (PSHZF US), which has a large position in CMG. Our position is now up over 100%.