This conservative property group that generally owns government tenanted buildings yesterday launched a bid in partnership with HostPlus to buy pub group ALE Property Group (LEP) at a huge 53% premium to their last stated net asset value. Obviously pubs are mostly closed however if things go back to normal and they start to collect rents as usual, the proposed purchase is on a yield of 4.8%, simply another example of the weight of money sitting on the sidelines for long life assets.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

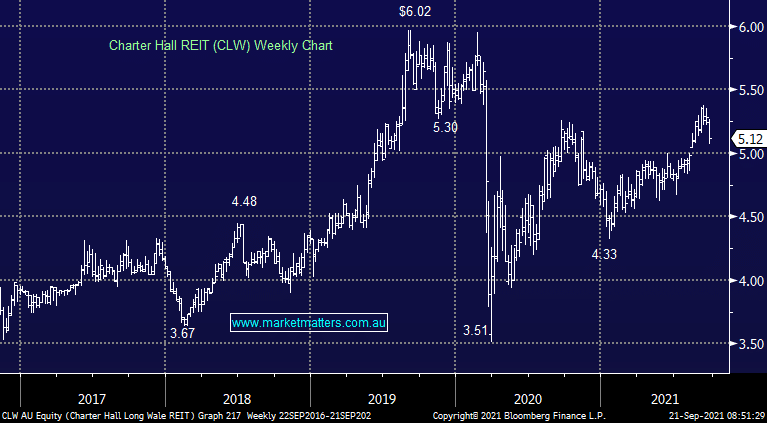

MM is neutral CLW around $5.10

Add To Hit List

Related Q&A

Which REITS have the most capital upside?

Thoughts on Charter Hall REIT (CLW) after its result?

Does MM like REITS CLW & CHC?

What does MM think of CNI, CLW & LLC into current weakness?

MM’s Thoughts on CLW?

MM thoughts on CLW

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.