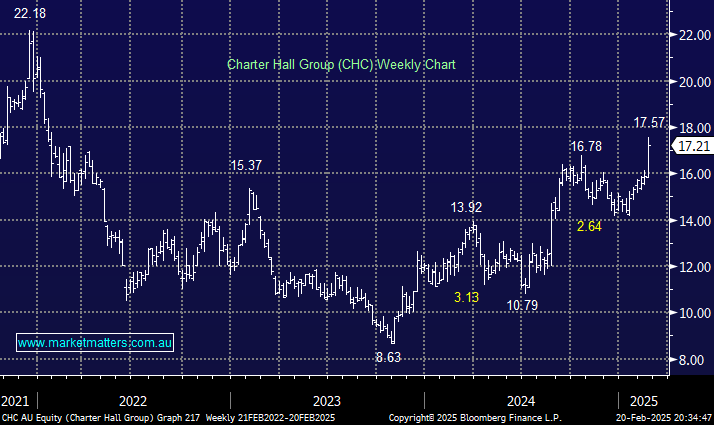

CHC produced an 1H profit turnaround despite a revenue drop, propelling its shares to a 52-week high. The company also upgraded its fiscal 2025 post-tax earnings guidance by 2.5%.

- Revenue of $283.6 million was down -8% YoY.

- Net Income of $61.1 million v loss of $190 million YoY.

- A dividend of 23.42c was declared, up from 22.09c, putting the stock on a part franked yield of ~3.25%.

Funds giant CHC, best known as the owner of office towers and commercial property, has quietly assembled a portfolio of 1,000 apartments for development as it explores opportunities to address the national housing shortage – a smart move, in our opinion, as the government fails to reach its housing targets. The welcomed upgrade was accompanied by an equally upbeat assessment of the broader commercial market, a correction that MD Harrison believes is all but over.

- We like the outlook for CHC but will be watching for failure after it breaks above its 2024 high.