Nvidia is giving us two sections for one this week! This week’s chart comes with some context regarding the company’s position. Last week, Nvidia Corp. Chief Executive Officer Jensen Huang’s two hours on stage on Tuesday at a packed arena in San Jose, California, took a distinctly different direction from many tech companies. Rather than focusing on the marvels of AI that his chips can and will produce, Huang’s presentation was all about generating a return on the expensive gear being installed now and in the near future. The underlying message was that customers would need to continue spending on (his) new equipment to remain best positioned to capitalise on all the AI work coming down the pipeline – talking his book, as they say!

- We’ve built the foundation needed to create AI. Now, we need to deploy it in the real world in a way that’ll justify the expense – Nvidia CEO.

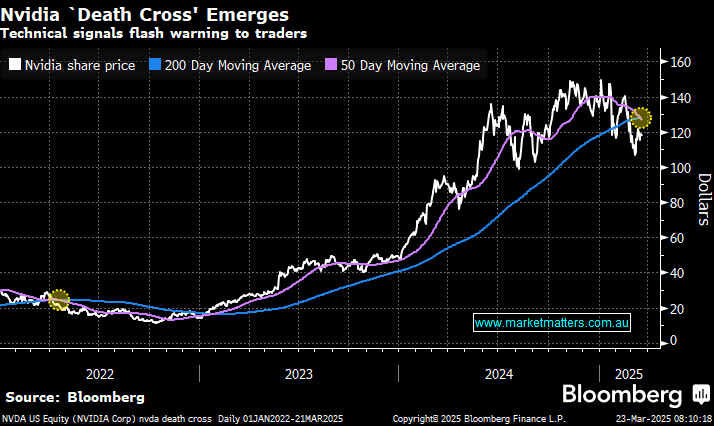

Nvidia Corp. investors that are accustomed to significant announcements and equally large stock gains during the company’s week-long GTC conference were left wanting this time around. The presentation, while pragmatic, did nothing to boost the stock, which is accustomed to euphoria. On Thursday, Nvidia’s 50-day moving average fell below its 200-day moving average, marking the stock’s first bearish death cross since January 2023. The last time it occurred was in April 2022, when shares plummeted by more than 30% over the subsequent two months.

- We are being patient toward NVDA from both an investment and trading perspective, with the “death Cross” capable of delivering some self-fulfilling selling.