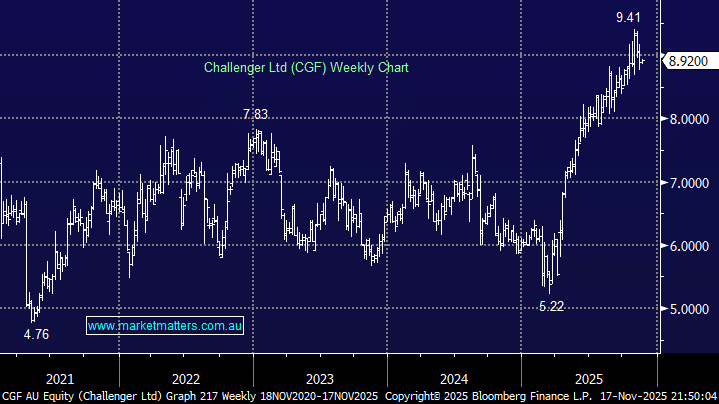

The provider of retirement income products and annuities, complemented by a growing funds management business has delivered for investors through 2025, surging almost 50% when many other ASX fund managers have struggled. The stocks benefitting from APRA’s proposed changes to the capital framework for longevity products – the changes will have several benefits for CGF, including lowering the levels of required capital and materially reducing the procyclicality of their capital position during periods of market stress. The stock is also benefiting from rising bond yields and widening credit spreads as the ducks align.

CGF’s FY25 result was largely in line, with stronger 4Q annuity sales and 2H spread margins pointing to a more positive outlook for their Life business. However, with the upside from new APRA capital standards – due partway through FY26 – already priced into the stock, it’s no longer compelling to MM with the stock trading on the expensive side of history.

- We like the evolution of CGF through 2025, but it feels fully priced at around $9.