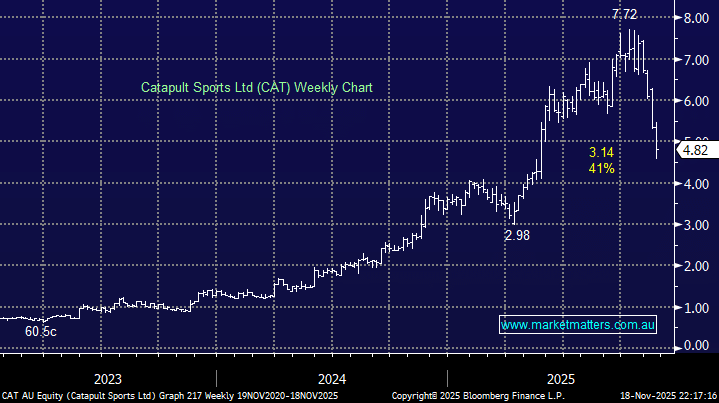

Catapult shares took a bath yesterday, falling as much as 16% at the lows (finishing -11%), despite delivering a solid set of 1H26 numbers that were in line with or above the midpoint of guidance on every major metric. The headline concern was the lift in Annual Contract Value (ACV) churn to 4.9% (vs 4.3% in 2H25), but that looked to be more a result of their planned exit from Russia than anything more widespread. Excluding this, churn was flat YoY and lower HoH, suggesting underlying customer retention is stabilising.

In addition to higher churn, costs also came in higher than expected, pushing the 1H loss to $5.2m, however, within that was a $3.5m debt repayment, making them now debt-free, with net cash of $11.3m. Both UBS and Jeffries shared this positive view, reiterating their buy calls on the stock.

- Revenue: $67.6m, +17% YoY

- Management EBITDA: $9.73m, +56% YoY – above company guidance of $9.0m-$9.5m

- Net loss: $5.2m (vs $5.5m a year ago)

- EPS: -$0.032 (vs -$0.029 YoY)

- Annualised Contract Value (ACV): $115.8m, +20% YoY

- Professional teams: 3,878 customers (+12% YoY)

NB: ACV = the yearly value of a customer’s subscription contract. For example, if a sports team signs a 3-year contract worth $300k, the ACV = $100k per year. ACV tells us how fast the customer base is growing, whether the company is upselling (ACV rising), or losing customers (ACV falling), and how predictable future revenue is. Growth of 20% in ACV is very strong.

CAT ended the half in good financial shape, reflecting a cleaner, more flexible balance sheet. In terms of guidance, they flagged strong ACV growth in 2H26, lower underlying churn once Russia rolls out of the base and flagged positive momentum in professional team onboarding, with FY26 Free Cash Flow expected to exceed FY25’s $8.6m

The share price move looks like an overreaction, and in MM’s view, linked to the strong run-up in the share price over the past year, more so than anything untoward in the numbers. We continue to believe that CAT remains a high-quality global SaaS business with improving cash flow, a strengthening balance sheet, and clear operating leverage.

- Having trimmed our holding above $7, we now have some flexibility to add to it once again, and if we had no position, we would use weakness below $5 to accumulate the stock.