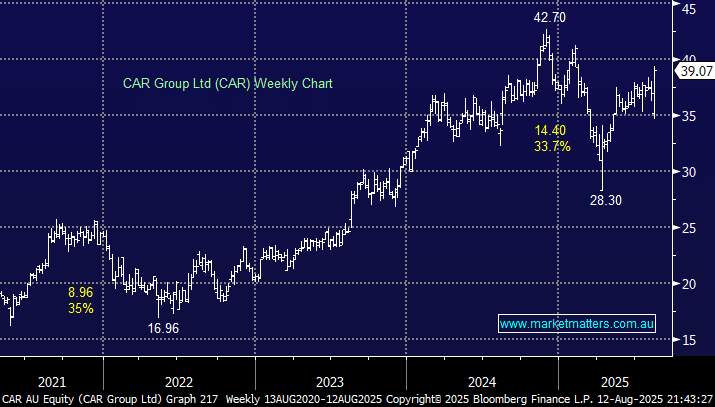

A month ago, CAR released a weaker-than-expected report and announced the departure of its long-standing CEO. At the time, we saw better risk/reward elsewhere and took profit from our position. This looked on point on Monday, with the stock trading below $35 following its result as the ASX200 pushed up to new highs. This week’s FY25 result, which was mostly pre-reported last month, saw mixed trading on Monday before driving up +5% on Tuesday:

- Revenue from continuing operations $1.18bn, +7.7% YoY, estimates of $1.15bn.

- Adjust EBITDA $641mjn, +10% YoY, estimate $39.4mn.

- Final dividend of 41.5c v 38.5c YoY.

- Forecast FY26 Rev Growth 12-14% and Ebitda growth 10-13%.

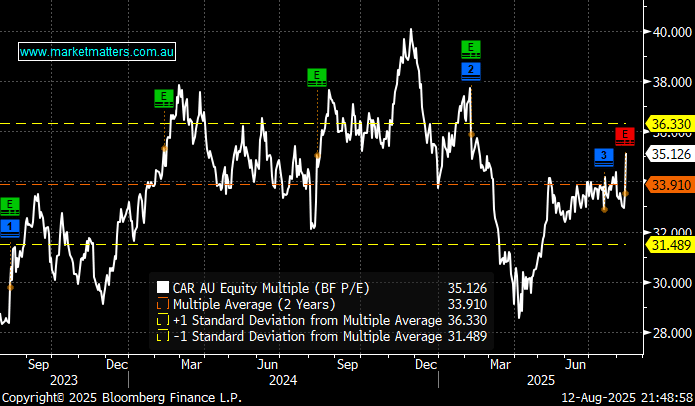

CAR is still firing on all cylinders with the dominant Australian car classified business evolving into a global player with healthy businesses in the United States, Brazil and Korea, while continually finding ways to grow the core Australian business. CAR Group’s Cameron McIntyre will hand over to his CFO, William Elliott, at the end of the week. McIntyre finishes up having helped CAR make record revenue, earnings, net profit and earnings per share in FY25. There’s no significant new information to hand. Still, with revenue forecast to grow at 12-14% in FY26, we must consider if CAR should be back on the MM radar, with it trading mildly above its 2-year and 5-year average valuation. At the same time, significant PE expansion has rolled through many other market sectors as global equities post new highs.

- CAR is trading less than 5% above its average 2-year valuation in an increasingly rich market.

As a marketplace business focused on vehicle sales, CAR benefits from rate cuts as lower interest rates tend to stimulate used-vehicle sales, as car loans become cheaper with improved consumer confidence also providing a tailwind for upgrades. Finally we have the EVs which are enjoying a second lease of life as the likes of BYD bring more affordable quality options to market. CAR looks to be a well-positioned, relatively cheap, quality company positioned for future growth with limited downside at this stage of the economic cycle, a solid combination as the ASX200 advances towards 9000.

- We can see CAR trading to new highs into 2026, initially another 10-15% higher – we have added CAR back onto our Hitlist.