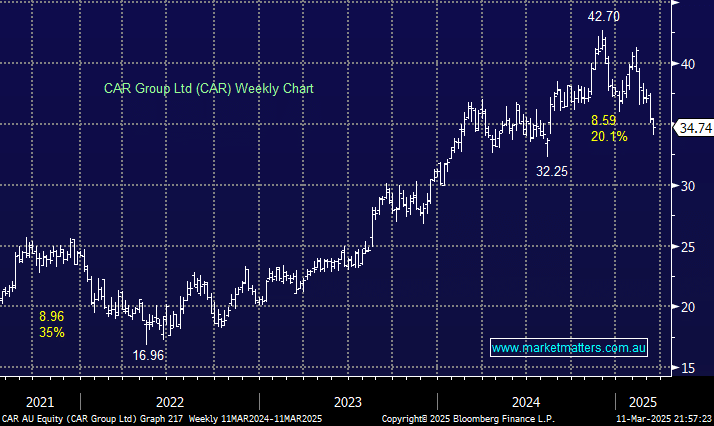

CAR has corrected more than 20% since its late 2024 high, a slower pullback than many growth names of late but meaningful nonetheless. This is a quality global business whose revenue of almost $580mn for 1H25 is healthily split across the world: 47% Australia, 25% North America, 17% Latin America and 11% Asia while illustrating the potential for ongoing global expansion. This international digital marketplace specialises in online automotive classifieds and related services, generating diverse revenue through more areas than many would think:

- Online Automotive Classifieds, Display Advertising Services, Finance Commissions, Automotive Data Services and Online Retail and Wholesale Tyre Sales and Inspection Services.

While the traditional online advertising segment is dominant, delivering almost 70% of the group revenue, it’s encouraging to see the company successfully leverage the traffic that uses its platform. February’s result was solid, which we found encouraging, given the challenging industry conditions in the US, leading to the delayed timing of US price increases and lowering of guidance to ‘solid’ from ‘good’. However, this was a resilient performance from Trader Interactive in North America, with the business well-positioned for further growth when the market improves. We can also see a significant upside for the company’s Consume to Consumer (C2C) platform, with ~$30mn worth of transactions already processed.

- The U.S. tariffs may not directly target CAR Group, but we are conscious that the broader implications for the automotive industry could indirectly affect its business operations.

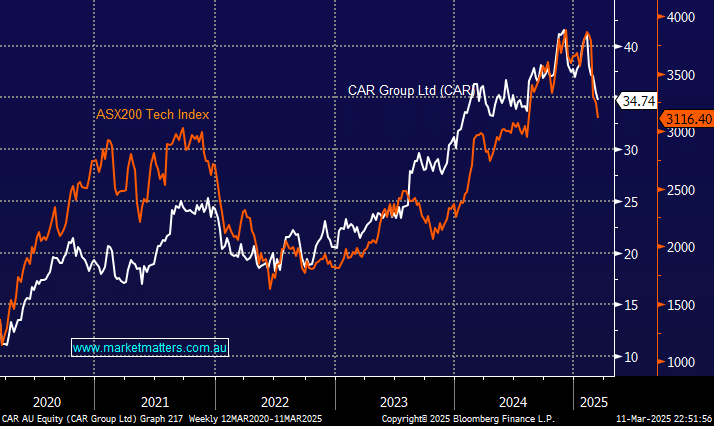

The digital nature of the business has not surprisingly led to CAR’s performance being highly correlated to the tech sector in general, which we believe is starting to “flash oversold.”

- CAR will likely trade as a growth/tech stock for the foreseeable future, which can be good or bad news depending on the cycle.

Snippets of commentary delivered with the February results by CEO Cameron McIntyre sums up why MM likes this quality business:

- “We operate in diverse geographies with large, under-penetrated, addressable markets. We have multiple levers to deliver future growth and are accelerating the exchange of knowledge and ideas between our global businesses. With a robust balance sheet and prudent leverage, we are strategically positioned to invest in further innovation and continue to deliver excellent results for our customers.”

Following its recent pullback, we again believe CAR presents an attractive investment opportunity. The stock trades on a 12-month forward P/E of ~35x and ~15% projected earnings growth over the next few years.

- We are looking to re-enter CAR, having sold out in December above $40 on valuation grounds.

*Watch for alerts.