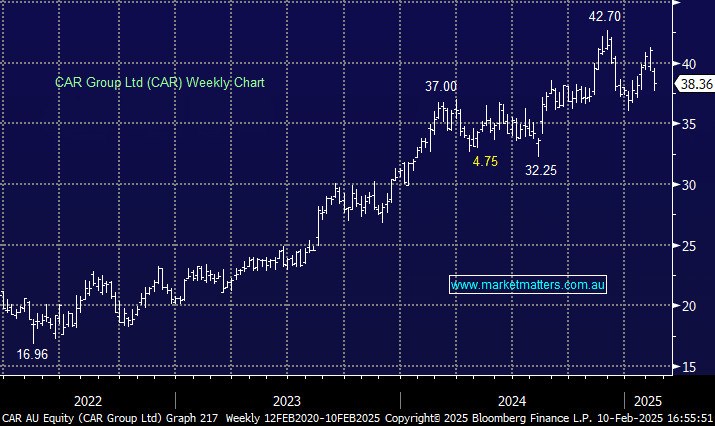

CAR –6.51%: The stock was hit today on a slight miss at their 1H25 results and higher than expected capex guidance. While the result was solid and resilient given tough industry conditions in the US, the stock has had a good year, and today’s result and typical guidance for ‘good growth’ just couldn’t justify the share price.

- Revenue of $579.4 million, up +9.1% y/y, slightly ahead of expectations

- Underlying net income $177.3 million, up +9% y/y and a miss to $180.5m consensus

- Interim dividend per share $0.385 vs. $0.3450 y/y

They did reconfirm FY25 guidance, typically vague as always for ‘good growth’, however one component within that referenced their US business, where they lowered guidance to ‘solid’ from ‘good’, related to delayed timing of US price increases.