Energy is a huge requirement to drive AI, and as usage expands, AI data centres are projected to consume city-scale power levels, potentially reaching 4% of global electricity use by 2030. AI workloads are much more power-intensive than traditional computing, with each generative AI query (e.g., ChatGPT) using 10–100× the power of a Google search. The likes of Meta, Amazon, Alphabet and Microsoft have publicly announced long-term agreements or investments to source nuclear power to support their rapidly growing data‑centre and AI infrastructure. With the world striving to achieve net carbon zero goals, just as AI is set to consume unprecedented amounts of power, MM believes uranium adoption will only increase.

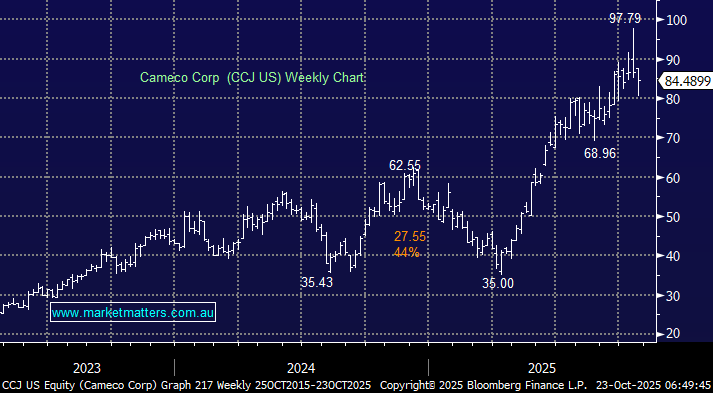

US-traded Cameco is the largest listed western uranium producer, and while it has slipped in the last fortnight, it’s still up more than 100% from its 2025 low. The Saskatchewan-based uranium has benefited from the US efforts to boost national stockpiles and strengthen nuclear fuel supply chains. The U.S. has been working to reduce reliance on Russian uranium, and as one of the world’s largest and most reliable uranium producers (with assets in Canada and the U.S.), Cameco has seen increased contracting volumes, rising prices, and stronger demand visibility. Also, the U.S. Department of Energy (DOE) has been purchasing uranium for its strategic reserve, helping Cameco develop a robust order book with a contracted portfolio that now extends well into the 2030s.

- We like the uranium/nuclear thematic in the years ahead, and believe the current weakness in CCJ is a great buying opportunity.