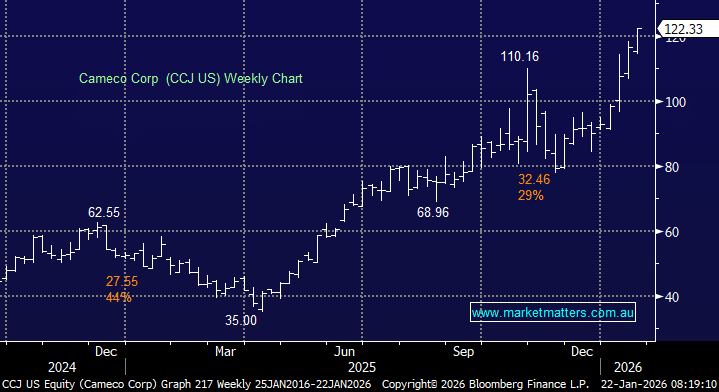

Cameco is the world’s largest publicly traded uranium producer, headquartered in Canada, supplying uranium fuel to nuclear utilities globally, with flagship assets including Cigar Lake and McArthur River/Key Lake in Saskatchewan. Its market cap is more than 10x that of PDN. Overnight, the stock surged another +5.6% following the conciliatory speech from President Trump, combined with the added spice of bullish commentary around uranium to satisfy the US’s future energy requirements.

For Uranium bulls, CCJ is the ‘must own’ global stock, with diversified exposures throughout the nuclear value chain. It’s lower risk than many in the sector, although we do think they are ‘short pounds’ and could well be looking for acquisitions, making smaller targets potentially more lucrative.

They delivered $US3.1bn revenue in FY25, which is forecast to lift to $US4bn by FY27, with revenue growth being driven mainly by higher realised uranium prices and increased sales volumes under long-term contracts, complemented by expansion in its fuel services business and contributions from its Westinghouse investment. CCJ is profitable and pays a small dividend, with its next chapter all about nuclear adoption and the uranium price.

- We can see CCJ extending the last year’s gains for the foreseeable future: MM owns CCJ in its International Equities Portfolio.