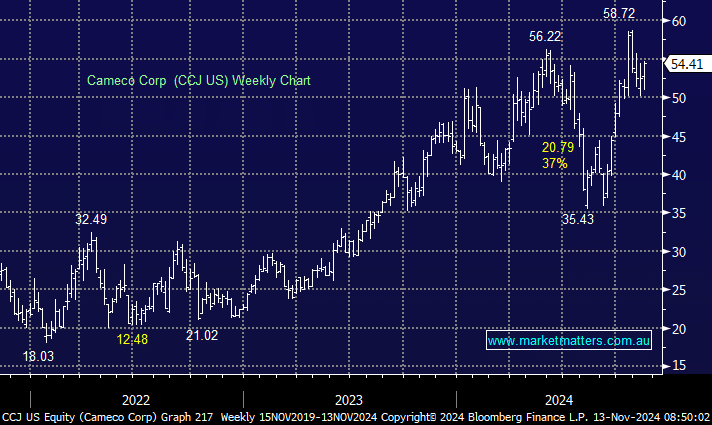

The chart of Cameco below yields little resemblance to that of Paladin Energy (PDN) which yesterday flagged meaningful production issues at their Langer Heinrich operation in Namibia, with shares down ~40% in the past month. CCJ has held up remarkably well in the face of a global sell-off in Uranium-linked equities, trading only ~10% below all-time highs. We own CCJ from mildly lower levels and we’re questioning whether to take advantage of the relative outperformance.

CCJ released 3Q24 results last week that showed strong operational performance, though it was a weaker quarter from an earnings and cash flow perspective. Interestingly, they upgraded production guidance at McArthur River/Key Lake from 18Mlb (100% basis) to 19Mlb while they remain on track for 18Mlb (100% basis) from Cigar Lake. There was concern in the market that these production rates were too optimistic. That said, the production issue comes in when looking at their Inkai JV with Kazatomprom and for that reason, they increased their guidance on spot purchases from ‘up to 2Mlb’ to ‘up to 3Mlb’. CCJ are buying in the spot market because they have too many contracted pounds relative to current production, so they need to buy extra pounds to fulfil deliveries. That’s a drag a cash flow and a situation that caps their leverage to rising U prices.

- Ultimately, Cameco is the world’s largest listed Uranium player, and with the nuclear thematic gaining traction, we intend to hold CCJ in the International Equities Portfolio, despite its relative outperformance.