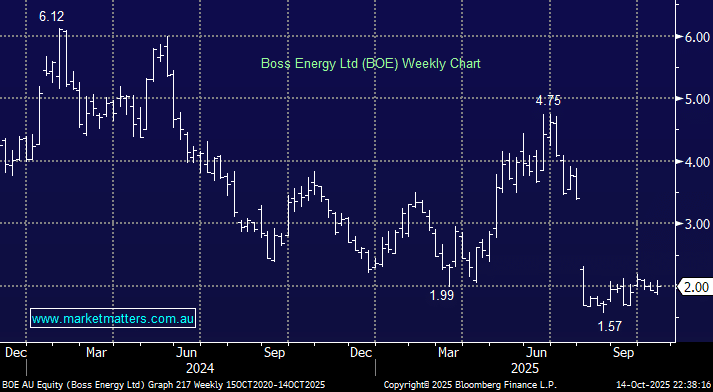

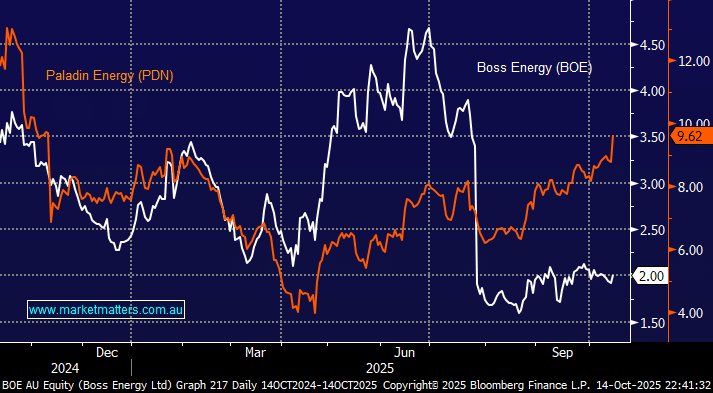

BOE plunged ~45% in one day back in July, and it’s drifted ever since, while other local and global uranium stocks have soared. In the US last night, heavyweight Cameco (CCJ US) again posted new all-time highs, while Paladin (PDN) has charged ~150% higher from its 2025 low. Firstly, let’s revisit the issues around that fateful day in July:

- Their Q4 production ~349klbs of uranium was a 4% beat vs consensus, BUT FY26 All-In-Sustaining-Cost (AISC) of $US64-70/lb came in materially higher than consensus, which was closer to $US50/lb.

- Following the update, management identified potential challenges that may arise in achieving nameplate capacity in FY27 and beyond, i.e. they moved the goalposts!

We were on the call with management after the shock announcement and MM’s interpretation was that the total resource estimate remains unchanged and is not necessarily at risk. However, the uncertainty is what it will cost to get to nameplate capacity, with more clarity to be provided via an independent report, which is due for completion in the December quarter. Our interpretation ties in with the update at the time; the uranium is there, but it’s costing more to extract it.

The recent rally by the spot uranium price will alleviate some of the cost issues for BOE, but the stock hasn’t followed its peers higher, with uncertainty keeping investors on the sidelines. However, professional traders are taking a more cautious approach to the other side of the coin, with PDN and BOE posting the largest decline in short positions last week. If the Independent Review isn’t “too bad”, the upside is likely to be sharp and dramatic, with investors looking for exposure to the uranium thematic.

As we said, Boss Energy said it expects to complete the operational review started in July at its Honeymoon uranium project in South Australia by the December quarter. At MM, we believe the key question is how many additional wells will be required, and what the additional cost to get there will be. Investor confidence has been shattered by the poor communication to the market, but the question now is whether BOE has become a bargain or comparted to the likes of PDN.

BOE has a few strings to its bow although the Honeymoon uranium project is the focal point:

- It owns 100% of the Honeymoon project which has a resource base of over 70 Million lbs (Mlbs) of U₃O₈, assuming the issues are cost-based as we think.

- It owns 30% of Alta Mesa Uranium Project (Texas, USA), which has ~3.4 Mlbs measured and indicated, plus ~17 Mlbs inferred U₃O₈.

- It has also taken a ~20% Strategic Stake in Laramide Resources (LAM CN), a relatively small $CAD215mn Canadian uranium business.

While diversification is good, it’s clear to see that BOE $830mn valuation is anchored to the Honeymoon resource. As a comparison $4.2bn PDN has ~400+ million lbs U₃O₈ globally, with its flagship mine being the Langer Heinrich Mine in Namibia, which is delivering as we saw yesterday, from its issue-free September quarterly update that reaffirmed confidence in its operations moving forward. PDN’s market cap is 5x BOE’s and its resource base is more than 5x BOE’s plus it doesn’t have the current risk hanging over its head.

At the moment, the market has placed BOE firmly in the naughty corner, while PDN has become the flavour of the month, but things often change in the volatile uranium space. While the uranium price is not the most transparent, it’s trading ~10% higher than when the BOE share price plummeted. Hence by simple back-of-the-envelope maths, if BOE AISC for FY27 and beyond is going to be closer to $US70 than the previously forecast $US50, half of the damage has been recouped by the underlying uranium price, still not good when combined with higher capital spending and lower production but we believe the shares are now priced for disaster, having not meaningfully recovered with the sector.

- We think the dials are turning for BOE from a risk/reward perspective, but PDN remains more attractive from a resource, operational, relative certainty and valuation perspective.