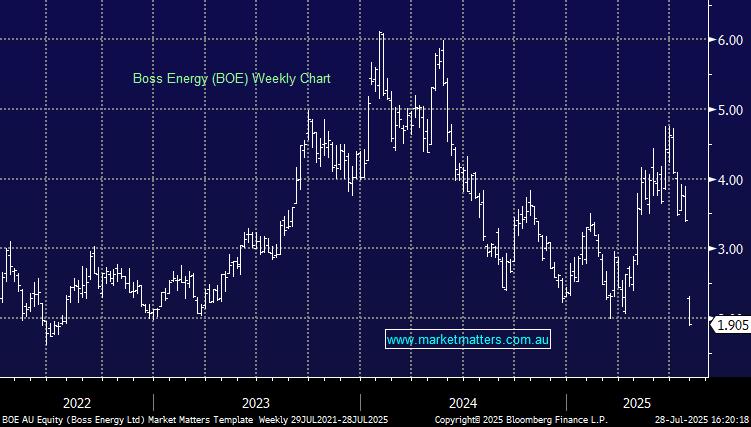

BOE -43.97%: Q4 uranium production exceeded expectations while sales lagged due to market strategy. FY26 costs were guided higher than expected, though the primary reason for the selloff was the revelation that management ‘identified potential challenges that may arise in achieving nameplate capacity’ in FY27 and beyond.

- Q4 production ~349klbs of uranium, a 4% beat vs consensus

- Sales of 100klbs U3O8, significantly lower than production reflecting BOE’s market strategy to retain Uranium when the price is not reflective of long-term value

- FY26 All-In-Sustaining-Cost (AISC) of $64-70/lb, materially higher than consensus

Management gave more detail on the investor call at 11am and our interpretation is that the total resource estimate remains unchanged, and is not necessarily at risk. Rather it’s a question of what it will cost to get to nameplate capacity, with more clarity to be provided via an independent report which is already underway.

Despite poor communication, the sell-off appears overdone given stronger uranium market fundamentals. With the stock currently trading at multi-year lows, the current share price does look like an attractive entry-point, however we suspect the stock remains under some pressure until the independent review is finalised and more clarity is provided – we are cautious as there is currently no deadline on this.