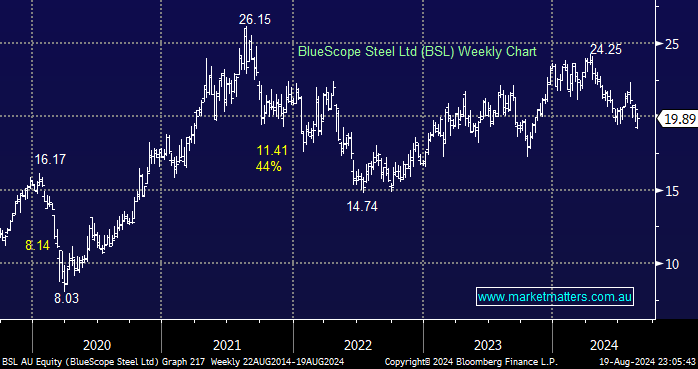

BSL fell -3.1% on Monday, although it was down almost 7% earlier in the session. The steel supplier reported a 22% decline in fiscal 2024 profit and soft EBIT guidance that was ~5% below UBS estimates.

- Revenue was $17.01bn, -6.4% y/y.

- Underlying profit $860.7mn, -22% y/y, consensus was $909.5mn.

- EPS $1.923 vs $2.367 y/y.

Much of the market was focused on 1H25 guidance, which came in 24% below consensus. Surprisingly, the market is relatively optimistic about BSL, with 7 Buys, 3 Holds, and 3 Sells—we saw nothing in their result to excite MM. Having a footprint in China a few years ago led to significant share price outperformance. Today, it’s the opposite, as we saw from BSL and a2 Milk (A2M) on Monday.

- The intraday recovery by BSL was encouraging for investors, but the macro backdrop is hard to ignore.