This major global energy ETF allows investors to gain exposure to the international energy names as it aims to track the NASDAQ Global ex-Australia Energy Companies, currency hedged. This ETF currently has 51.2% in US companies, followed by 17.8% in Canada and 12% in the UK, with 45 current holdings headed by well-known Shell, Exxon and Chevron. The ETF costs 0.57% to provide exposure to this basket of global energy stocks.

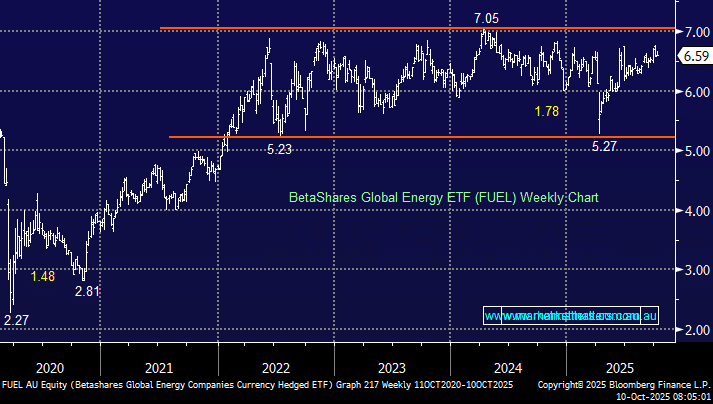

- We like the FUEL ETF for simple ASX-traded exposure to global energy; it’s outperformed the local index, and this is a year where the trend is your friend.

However, the FUEL ETF costs money to hold and yields around 1.8% pa unfranked. For investors who want to start positioning themselves for a turn in oil prices, Woodside (WDS) would get our vote; it’s highly correlated and pays a more attractive fully franked yield.