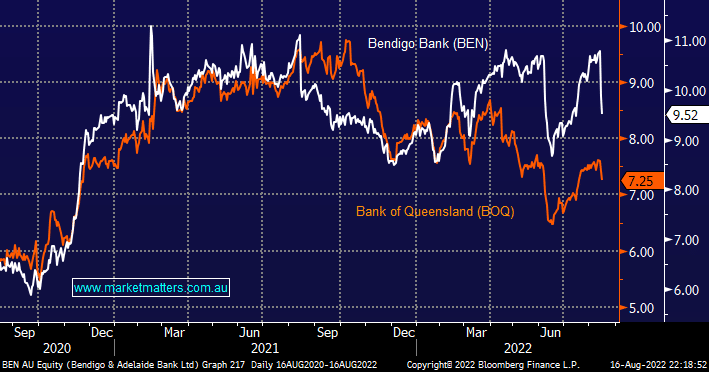

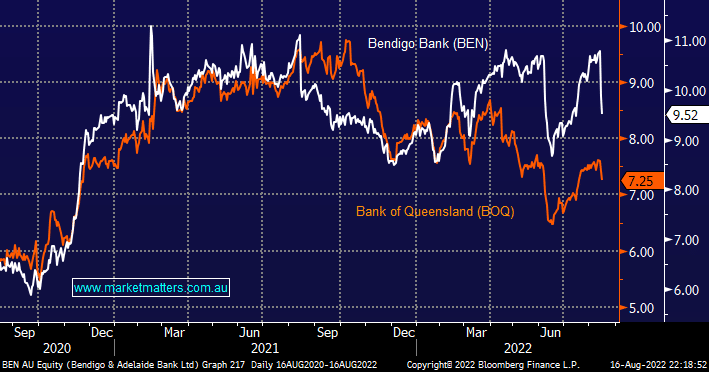

BEN reported this week and overall MM didn’t like what we read under the hood of the headline numbers i.e. The Net Interest Margin (NIM) was weak coming in at 1.74% but more importantly, they say they are less leveraged to higher interest rates than we thought. The biggest issue for us is we’re now likely to see FY23 downgrades as a consequence which will weigh on both itself and fellow regional BOQ which resides in the MM Portfolio.

- We cannot see any meaningful upside for BOQ until it reports in October.

Considering we already have a decent 9% cash holding we would usually be discussing a switch at this stage but nothing is clearly jumping out at us at current levels, this could easily change later in August but again we are comfortable adopting a degree of patience after the markets +11% rally from its mid-June low.

NB In terms of a switch within the Banking Sector we like National Australia Bank (NAB) at around $29, or 6% below yesterday’s close.