This tie up has been touted for some time however it makes total sense in MM’s view, both banks are capped ~$6bn and are in need of major IT upgrades, both in terms of delivering on customer expectations on the technology side plus of course meeting growing regulatory demands. If a deal was to be done, we would expect both BOQ and BEN shareholders would benefit.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

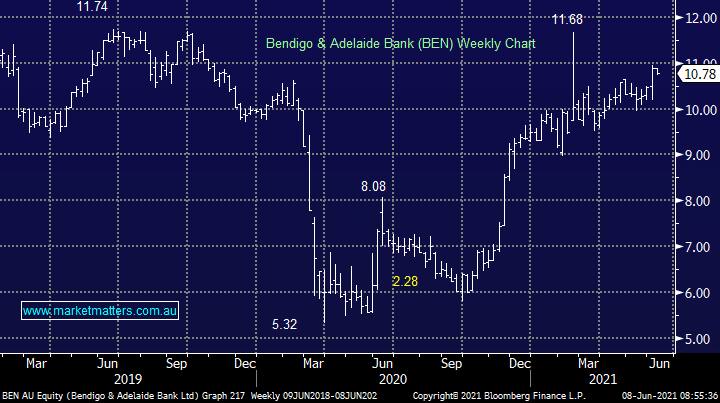

We like the prospect of a BEN/BOQ tie up

Add To Hit List

Related Q&A

Are BOQ and BEN potential for falling knife candidates?

The future for Bank of Queensland (BOQ)

Why has Bendigo (BEN) outperformed Bank of Queensland (BOQ)?

What are MM’s thoughts on the “Big Banks”?

Which Banks to hold

Favourite banks into the reporting season + dividend/reporting plays

Does MM prefer BEN or BOQ moving forward?

Do you think the current dip a good opportunity to add or build positions?

Tackling Aussie Banks

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.