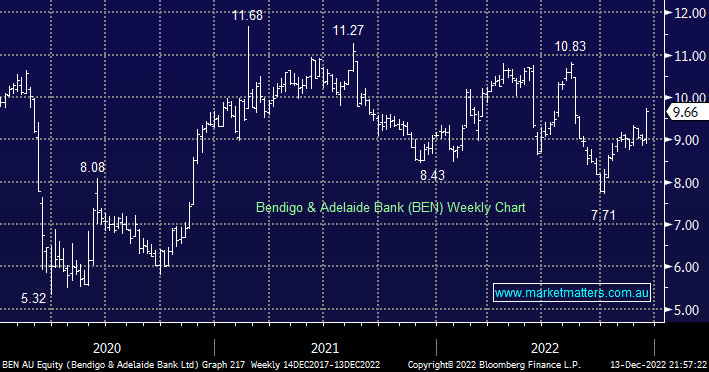

BEN rallied +6.86% on a better-than-expected trading update with cash earnings of $245m for the 5 months to 30 Nov coming in around 15% ahead of consensus. MM currently holds two banking positions in our Flagship Growth Portfolio, 5% in Commonwealth Bank (CBA) and 7% in Macquarie Bank (MQG), well below the Banking Sectors weighting which is now well above 20% hence the question do we need to buy more banks. The aspect that surprised MM most yesterday about BEN’s result was their leverage to higher cash rates driving better margins across their book. While Net Interest Margins (NIM’s) for the 5 months were 1.85%, the exit margin which is measured at the end of the period was above 2% which should help to drive earnings growth that will likely exceed 15% in FY23. On a Est PE of 11.1x with earnings to grow at that sort of clip, whilst also paying a forecast yield of 6.8% fully franked, the argument to own BEN is a strong one.

These sorts of trends are playing out across the sector, however, there is a key variable that we must consider. Given BEN’s leverage to higher cash rates now, that leverage will exist on the other side of the ledger, and if cash rates are falling, the economy is struggling with bad debts on the rise. While not without risk, we believe our ‘underweight’ stance towards the sector needs correcting, and with 12.5% held in cash, we are now looking to increase our exposure.