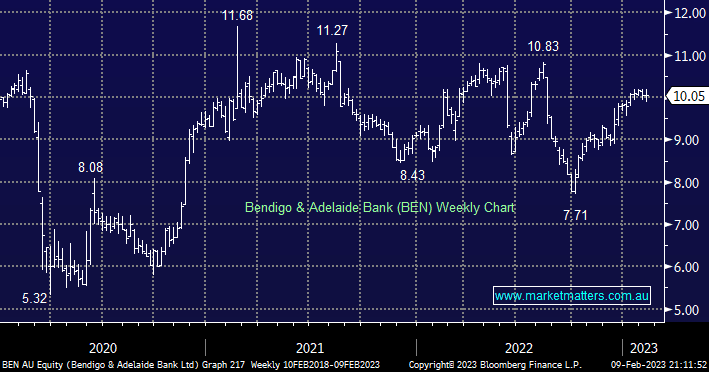

BEN saw its total housing loans shrink -0.2% for December and as we said previously MM believes this is likely to continue over the coming quarters. However they delivered a solid trading update in December reporting cash earnings of $245mn for the 5 months to November 30th overall a 15% beat of consensus estimates at the time which has seen the stock rally in recent weeks. BEN is currently trading on a 10.9x P/E, below both its historical average and the ASX200 Banking Sector, again similar to BOQ i.e. the market is already expecting a degree of underperformance from the regional banks which makes them interesting to MM into weakness.

- We like BEN around 4% lower especially with an Estimated 5.3% yield on offer over the next 12 months.