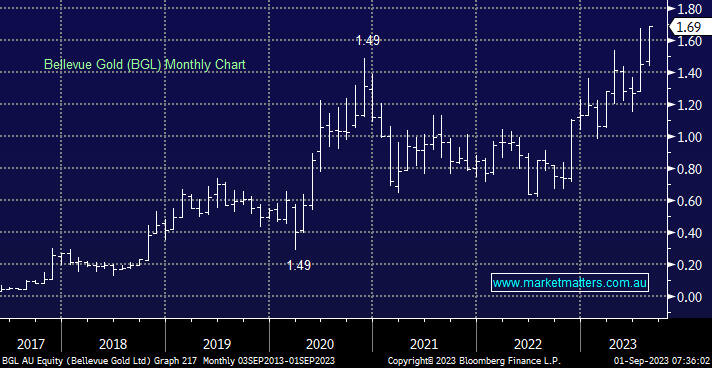

Gold miner BGL has been rerated over the last 12-months even while the sector trod water as their processing plant and surface infrastructure remains on track for Dec Q commissioning. BGL is nearing the finish line, it’s well-resourced and fully funded ($64m cash and $70m debt to draw) to execute, hence we like BGL into 2024 and beyond, especially when compared to many in the sector, but we are conscious this could be a quasi-example of “buy on rumour” sell on fact with relative performance likely fall back into line with the sector as production commences.

- We like this $1.9bn gold miner but the risk-reward has diminished as the stocks punched above $1.50 – worth stressing we are bullish on precious metals into 2024.