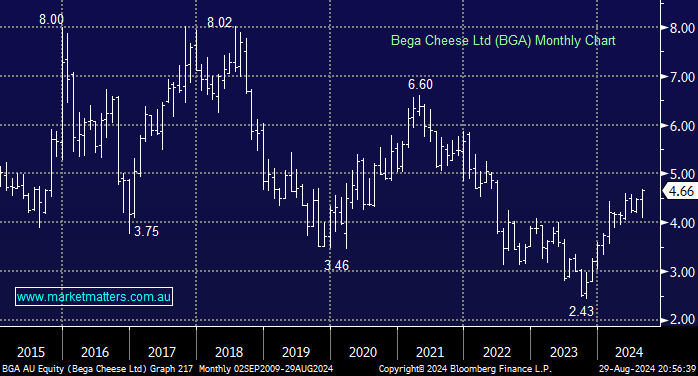

Australian dairy producer BGA soared +9.4% on Thursday, enjoying a rare day as the main board’s top-performing stock. The stock hit a 52-week high in the process, following a swing back into profitability in fiscal 2024 and forecasted EBITDA for FY25 that was ~1% ahead of expectations.

- Net revenues of $3.5 billion, up 4.3% yoy, in line with estimates of $3.45bn.

- Normalised earnings (EBITDA) of $164.1 million, up 2.4% yoy, slightly ahead of $163mn estimates.

- A final dividend of 4 cents per share, fully franked, was declared.

Yesterday’s move felt like a sigh of relief instead of fresh bullish news/reason to chase the stock.

- We can see further upside for BGA, but it’s not on MM’s radar.