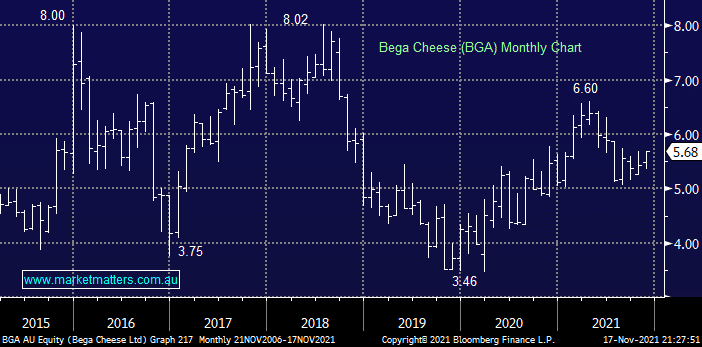

BGA has been on our radar of late as it pushes towards fresh 4-month highs plus considering its AGM was in October it’s unlikely that any bad news is lurking around the corner. The dairy business has been growing revenue encouragingly even while the disrupted Diagou channel has seen a softening of demand for its infant formula. Following the successful takeover of Lion Dairy and Drinks the revenue for the BGA business is now around $3bn, we like the companies profile moving forward.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Close

Close

MM likes BGA around $5.70

Add To Hit List

Related Q&A

Your further thoughts on Helia Group (HLI) and Inghams (ING)

Helia (HLI)

Bowen Coal (BCBBD) etc

Helia Group (HLI) – Elephant in the Room

Bega Cheese (BGA) – Australia’s Big, Little Food company

Thoughts on HLI Helio

Views on DEG, DYL and HLI

Does MM like Helia Group (HLI)?

Has BGA got its mojo?

Bega (BGA) & Seven Group (SVW) – when to buy?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 15th July – Dow up +88pts, SPI up +51pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.