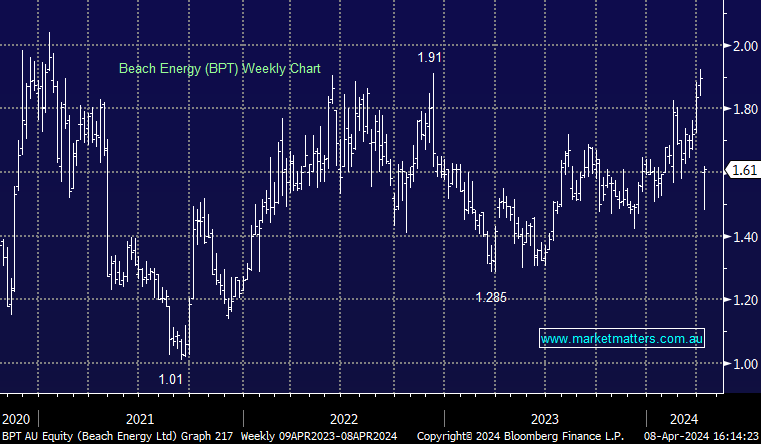

BPT -15.04%: the gas company announced the 3rd delay and cost increase to stage 2 of their Waitsia joint venture that was due to come on in just a few months. Capex expectations have been increased by $150m, or ~30%, just 1Q out from when the market was pricing in first production. Beach has blamed non-compliant valves & fire system issues for the cost increase and delays with manpower redirected to the remedial work required. This set back comes shortly after Beach announced cost-cutting targets, aiming to reduce the headcount by 30% and drive operational improvements. BPT shares closed near 3-year highs on Friday, today’s release showing plenty of cracks in their near-term outlook making it hard to justify the recent strength.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 11th July – Dow up +192pts, SPI up +27pts

Friday 11th July – Dow up +192pts, SPI up +27pts

Close

Close

MM is neutral BPT

Add To Hit List

Related Q&A

Energy Stocks: WDS, STO & BPT

Thoughts on XRO & BPT please

Does MM like BPT medium-term?

Why is BPT underperforming the oil price?

Is Beach (BPT) worth holding?

EOFY ideas

WPL vs BPT, NCM vs OZL

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 11th July – Dow up +192pts, SPI up +27pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.