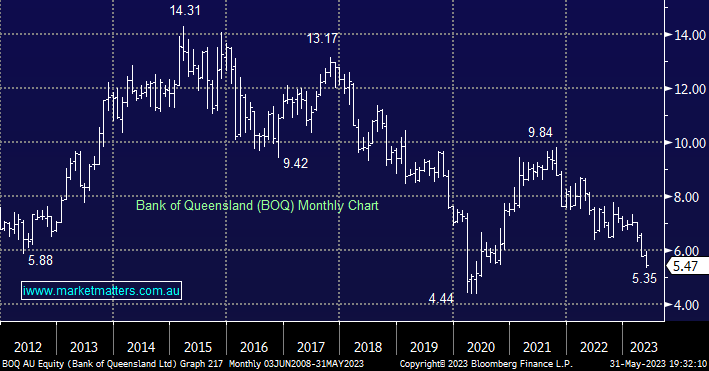

Australian regional bank BOQ fell -5.36% on Wednesday after announcing it had entered into an enforceable undertaking with both APRA and AUSTRAC on the back of risk and governance concerns – the stock is now down over 16% for 2023. The bank will need to appoint both an external auditor for AUSTRAC as well as an independent reviewer for APRA as they look to work through several concerns from the regulators – an expensive and time-consuming exercise. They have 120 days for submissions to both as well, while APRA has added an additional $50m in risk capital requirements while the issues are worked through.

In a similar fashion to the US regional banks both BOQ and Bendigo (BEN) have struggled compared to their local peers with major operational issues such as mortgage competition having already negatively impacted BOQ’s margins while rising deposit competition and higher wholesale funding costs have created additional headwinds– we see these issues continuing hence the valuation elastic band can stretch further, especially with the fresh regulatory worries. We see further downside risks for BOQ despite the valuation being close to extreme multiples e.g. BOQ is trading on an Est 7.9x valuation for FY23 compared to 9.6x for ANZ and 16.3x for stalwart CBA.

- BOQ may deliver a clean bill of health in 4 months but it’s hard to see the bank rewarding loyal investors while markets await the verdict i.e. if in doubt stay out in line with the market’s usual dislike of uncertainty.