BOQ delivered an undoubtedly strong result on Wednesday, especially with net interest margins (NIM) remaining robust. However, it doesn’t screen as favourably compared to the majors, paying a lower yield than ANZ and Westpac, our preferred picks. The AFR ran an interesting article overnight describing BOQ as the biggest experiment in Australian banking; the question is what comes next as CEO Patrick Allaway starts his 3rd year in charge. He successfully made some tough decisions, such as terminating the franchise model and avoiding mortgages until he could offer more competitive digitalised loans. While the bank is in a good position after a solid result, moving forward, it is always going to be tough competing with the bigger end of town and we don’t have plans to buy the QLD regional bank given our preference for others.

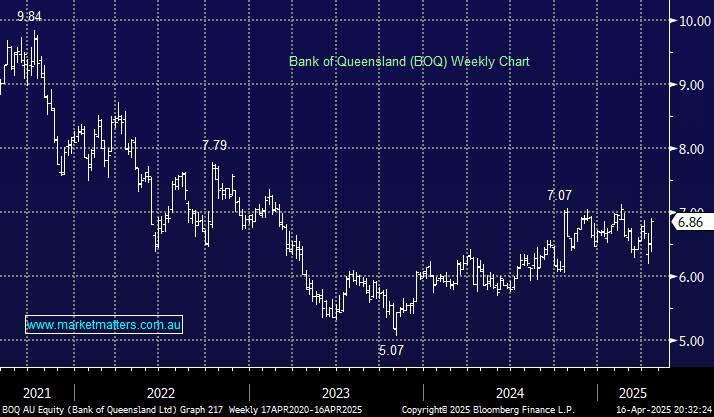

- We can see BOQ making fresh highs for 2025, into its 18c fully franked dividend on the 30th.