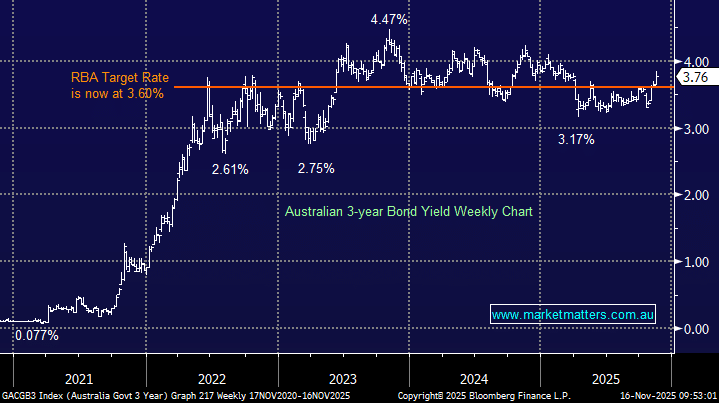

Last month’s surprisingly hot inflation print continues to weigh on credit markets who have now given up hope of a Christmas rate cut and are only “hopeful” of a 0.25% easing over the next 12-months, with the futures market pricing in a cut by May as a coin toss. Michele Bullock has remained conservative towards cuts through 2025 and we see no likely change without clear signs of a softening economy.

- We believe last month’s CPI has “moved the goal posts” and a continued squeeze up towards 4% by the 3s wouldn’t surprise.