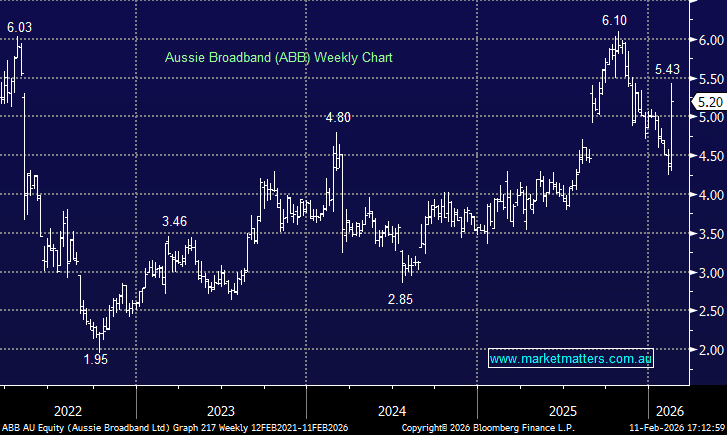

ABB: +14.79% rallied sharply today after announcing it will acquire AGL’s telecommunications business in a deal that strengthens its customer base and is expected to be earnings accretive within 12 months. The stock posted its biggest gain since August 2023 – up 20% at the highs before tapering off – as investors backed the strategic logic and earnings upside from the deal. We own both stocks across 2 MM portfolios, and we think todays deal is one of those rare win/wins for both companies;

Summary of the deal:

- Upfront consideration of $115m, paid in ABB shares

- ~22 million shares to be issued to AGL in June

- Additional earn-out of up to $10m in ABB shares (in $2m tranches) subject to net growth hurdles

- Transaction expected to complete in June

The acquisition will see AGL Telco customers migrated onto Aussie’s network, with the process expected to begin in Q1 FY27 and completed in H1 FY27. The deal increases scale for ABB, leveraging its existing network infrastructure and driving operating leverage. Management expects the deal to be EPS-accretive in the first year post-migration, a key point for a market increasingly focused on earnings delivery rather than just revenue growth.

For AGL, the sale sharpen its focus on core energy operations, with the stock also responding positively today – covered elsewhere.

After a tough period for small-cap growth names, today’s move suggests investors are prepared to reward credible, earnings-accretive expansion.