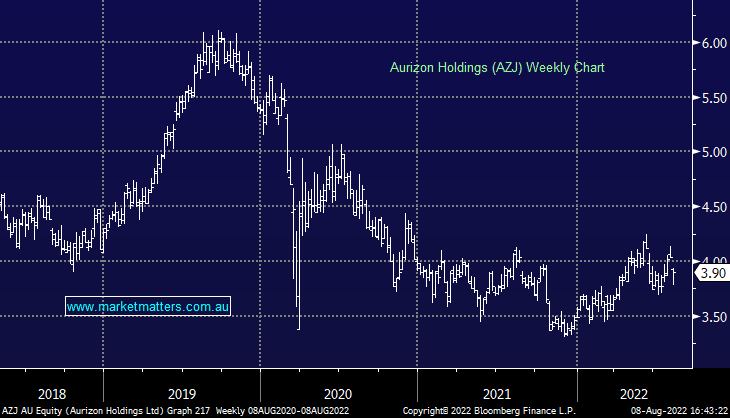

AZJ -3.47%: The rail haulage business fell today following their FY22 results plus they painted a weaker picture for FY23. They reported underlying earnings before interest & tax (EBIT) from continuing operations of $875.3 million, down -3.1% for the year but marginally above the markets expectations for $866.9 million. The final dividend per share of 10.9c was down from 14.4c last year, however it was the guidance that was a touch soft, about 2% below where the market was currently positioned. Overall, not a bad result and we applaud them for issuing guidance, we suspect a lot of companies may not.

scroll

Question asked

Question asked

Question asked

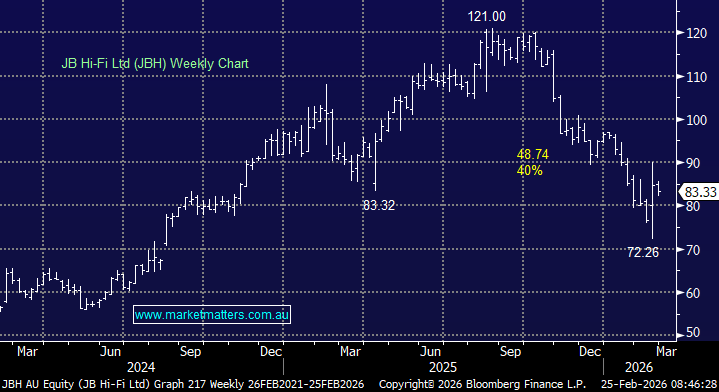

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

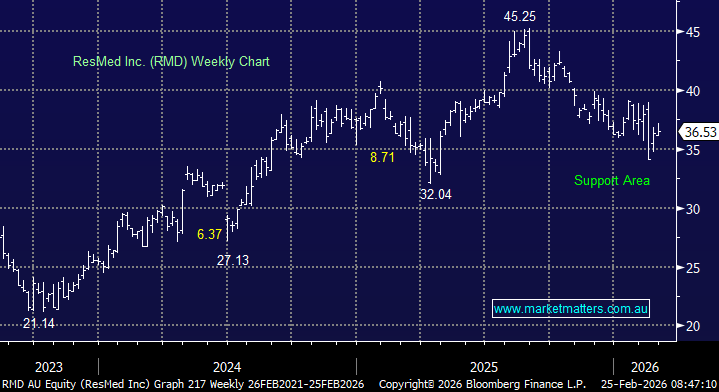

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM likes AZJ ~$3.80 as a defensive holding

Add To Hit List

Related Q&A

View on AZJ (Aurizon Holdings)

MM’s thoughts on PGC & AZJ?

Updated view on AZJ

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.