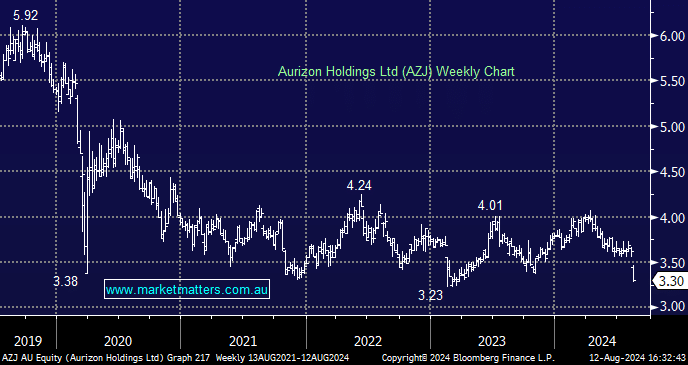

AZJ -8.84%: Fell on a weak FY24 result, particularly in terms of the two that count – profit and dividend.

- NPAT +11% to $406m but a 10% miss to consensus of $452m)

- FY24 full year DPS 17cpsm and 11% miss to consensus of 19cps (7.3cps final dividend 60% franked)

- FY25 Guidance was soft, expecting EBITDA of $1,660-1,740m , 3% below consensus

- They did announce a buy back, up to $150m

This is resilient business, but it’s a struggle at the moment and it lacks a catalyst in the near term.