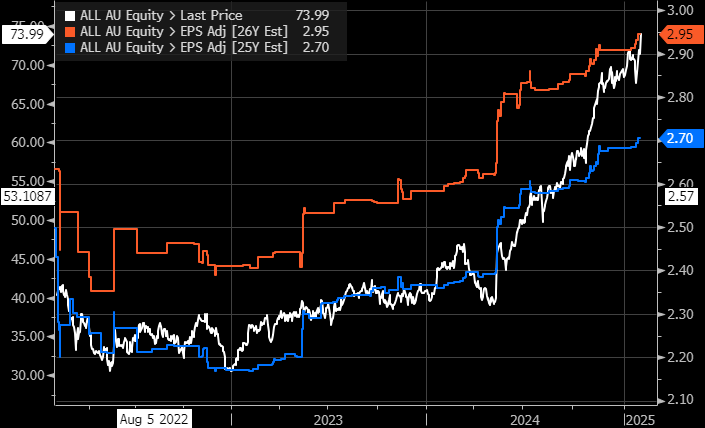

Gaming company ALL rallied +3.7% on Thursday, making new all-time highs, aided by Goldman’s upgrade earlier in the week from Neutral to Buy. The stock may feel rich/extended at first glance, but it’s simply tracked higher inline with earnings expectations, although it is now trading at the top end of its post-GFC valuation, leaving little room for disappointment. ALL delivered a solid FY24 result late last year, and we liked how they have decided to go back to what they know best: concentrating on finding opportunities in regulated gaming, i.e. poker machines and casino-style online games. It is a great company but not one we want to chase at current levels, and going out on a limb, another $8-10 pullback wouldn’t surprise us in 2025.

- We underestimated how far ALL would rise in 2024/5, but we don’t like the risk/reward above $70.

NB: The blue line shows consensus EPS forecasts for FY25, and the orange line plots the same for FY26. These are forward looking assumptions, based on an aggregation of analysts’ forecasts.