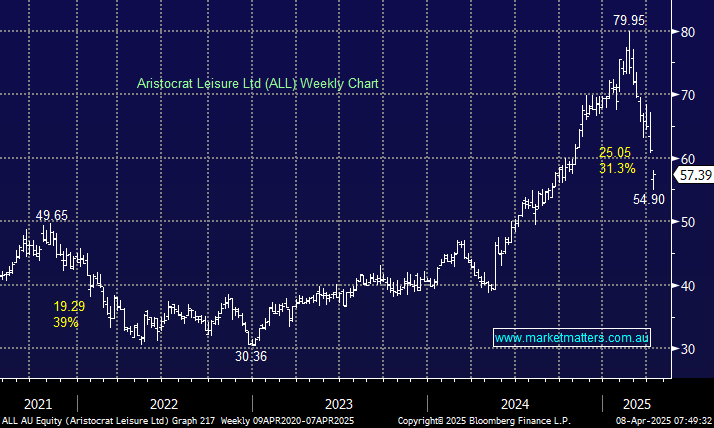

ALL has now corrected over 30%, more than we anticipated when we switched into the stock last week when it was already down significantly. The company has delivered exceptionally well over recent years, and it currently generates almost 50% of its revenue from the US. The company is already manufacturing its gaming machines in Nevada and Oklahoma, plus, of course, Sydney, although details are thin on the ground – nothing to garner the wrath of Trump here. Unfortunately, people still gamble in tough times, and although advertising revenue on Pixel may slip, we believe the stock is now on the cheap side of the ledger after its valuation re-rating; if we had no position, it would be on our shopping list today.

- We like ALL below $60 but are unlikely to increase our position given our current weighting: MM holds ALL in our Active Growth Portfolio.