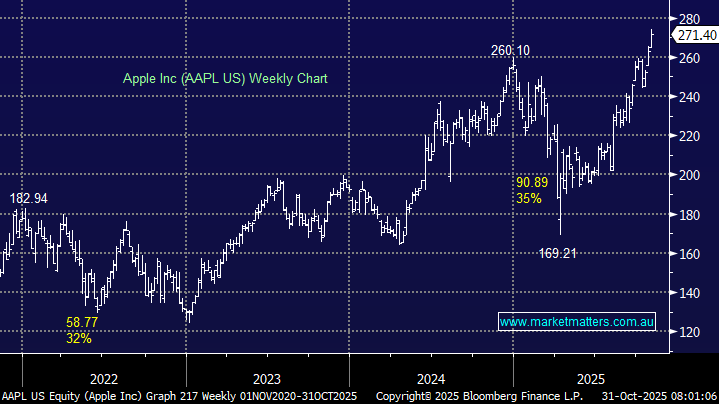

Apple reported stronger sales ahead of the holiday season although China revenue for the 4th quarter missed expectations. The stock advanced ~5% in late trade as a fired-up Tim Cook pointed out that there was no increase in previously flagged AI spend and the company is making great progress on the new Siri, coming next year, while CFO Parekh delivered an upbeat forecast for the holiday season – saying revenue will gain 10% to 12% in the December quarter, signalling that the iPhone and other Apple products will have a strong Christmas season.

- 4Q Revenue: $US102.47bn, +7.9% YoY, slightly above $US102.19bn estimate.

- Greater China revenue $US14.49bn, down -3.6% YoY, and well below the $US16.43 estimated.

- 4Q iPhone revenue of US49.03bn, below $US49.33bn.

- 4Q Earnings: US1.85/share vs est. US$1.77.

Apple has sprung back to life in recent months, with the company benefiting from stronger-than-expected services growth, helping offset a slowdown in China. The Mac and wearables division is also performing better than anticipated. However, China will remain tough with the company facing mounting competition from local smartphone providers as it struggles to offer AI features in the country. Overall, a solid result and outlook.