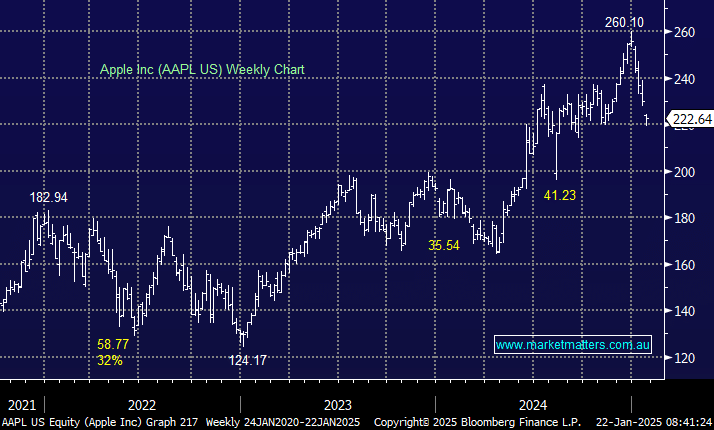

Last week, we exited our long-held position in Apple (AAPL US), taking a ~380% profit for the International Equities Portfolio – a great result but as we said at the time, all good things come to an end. We think the growth outlook for Apple has deteriorated and with the stock still trading on a growth multiple of ~30x, the risk/reward is no longer appealing.

The bulls will site the wall of demand coming as consumers buy new AI enabled products, and while we think that’s a logical assumption, it is currently built into expectations, which has the effect of inflating consensus numbers. The current evidence does not yet support this trend, particularly in China where more price-conscious consumers seem to be buying cheaper alternatives, Huawei Technologies for example surpassed Apple as the top seller in China, with a 15% year-over-year sales increase driven by new device launches while Apple’s China iPhone sales dropped 18% in the December quarter, causing a 5% global decline in iPhone sales.

While the decline in iPhone sales in China was partly due to the lack of accessibility of new AI features, as Apple seeks a local partner to provide AI infrastructure, it’s still a trend that has us concerned. Overnight, two US brokers echoed our concerns, downgrading their rating on the stock which pushed shares down ~4% in a rising market.

Looking forward, we’re expecting AAPL US to grow top-line revenue by mid-single digits, with earnings increasing slightly more. While this is reasonable growth, Apple is simply too expensive.