Yesterday, Apple held its first in-person event since the start of the pandemic, announcing that it was entering the Buy Now Pay Later space in the US, along with some changes to the MacBook and an update for the iPhone lock screen, essentially allowing a greater level of customization. While all this is interesting to think about, the main driver of Apple is iPhone sales – they are essentially an iPhone company, and this is the way that MM thinks about the largest ‘winner’ we currently have in the International Equities portfolio which is sitting on a paper profit of over ~200%. The iPhone has arguably been the most successful product ever made with the company selling more than 2.2bn units since its launch – not bad considering there are less than 8bn people in the world!

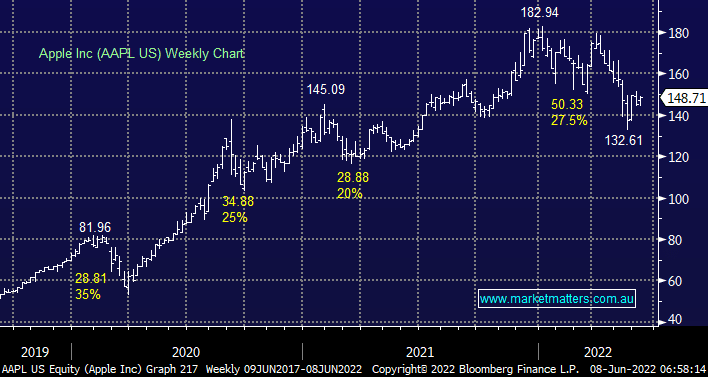

However, when a company has such a dominant leading product, we need to consider the risks associated with that and question whether or not these are being captured in the current price. If the iPhone stubbles, Apple would struggle. That said, following a near 27% pullback, Apple now trades on a P/E of 22x which is very close to its 5-year average. Top-line revenue is growing at more than 7% with EBITDA increasing nearer 10%. With cash on the balance sheet of $200bn, an economic downturn would be a positive for Apple in the longer term, it’s during these times they tend to invest more heavily when the competition is weaker, which is certainly the case with their BNPL product just announced. Overall, it’s very hard to argue with the longer-term outlook for AAPL despite its reliance on the iPhone.