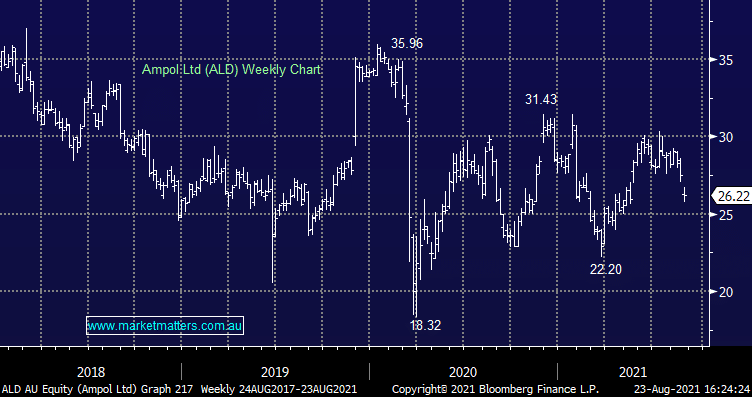

1H21 Result + proposed acquisition: Todays result was inline with expectations operationally so the focus was squarely on the news that they had launched a bid for NZ based Z Energy. The price offered is a big one, implying 9.1x EV/EBITDA while Z Energy has traded at 7.8x on average over the last 5 years plus they have had 4 profit downgrades in the past 2 years – ALD itself trades on 7.8x so the $2bn bid is a big one for the fuel and overpriced ice-cream retailer. However, the recent flow of deals clearly shows that scale is becoming the name of the game in the energy space and Ampol has gone hard at it bidding a 47% premium to the Z Energy share price prior to news speculation. Shares in ALD finished down 4.76% today.

scroll

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

All too rich for MM, we have no interest in ALD

Add To Hit List

Related Q&A

Dividends into reporting season

Thoughts on WDS and ALD please

Income shares

Ampol vs Viva

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.