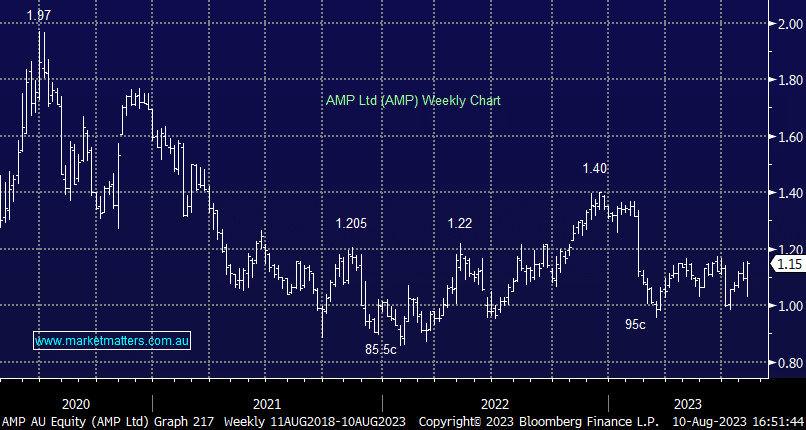

AMP +4.55%: the wealth management company announced 1H results this morning seeing a weak reaction from investors from the early sticker shock, however, shares ended higher as green shoots emerged digger deeper into the numbers and outlook. EPS was a small beat to expectations at 3.8cps, up 11.8% on last year, while NPAT was well ahead of the market on the back of a stronger than expected Wealth management result. The bank side of the business beat on Net Interest Margins (NIMs) at 139bps however guidance was a little soft, expecting to fall to 130-135bps in FY24. The main concern for the market is the Buyer of Last Resort cases currently being contended in court with AMP provisioning $50m for compensation, and placing the third tranche of capital returns for shareholders on hold for the time being as they work through the issue. They will also spend $120-150m over the next 2 years to cut their cost base by ~11% ($120m p.a.), it would be a great result if they can pull it off. The business still has a number of issues ahead of itself though the result shows that they are starting to look like a capable company again.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral to bullish AMP ~$1.15

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.