The markets embraced AMZN’s earnings beat in late April: Advertising revenue grew 24% in the first quarter, outpacing retail and cloud computing, plus Amazon Web Services also reported results that topped estimates. Earnings per share came in at 98 cents vs. 83 cents expected by LSEG (the data vendor used on the MM website).

Over the last 12-months, growth in Amazon Web Services (AWS) slowed as businesses trimmed their cloud spend. But Amazon executives have said they’re seeing cost optimisations taper off, and they’ve indicated that demand for generative artificial intelligence can deliver a boost for its cloud business. Interestingly AMZN remains a standout among mega-cap internet companies in that it’s yet to implement a quarterly dividend, even as cash and equivalents jumped to $73.9 billion in the quarter from $54.3 billion a year earlier.

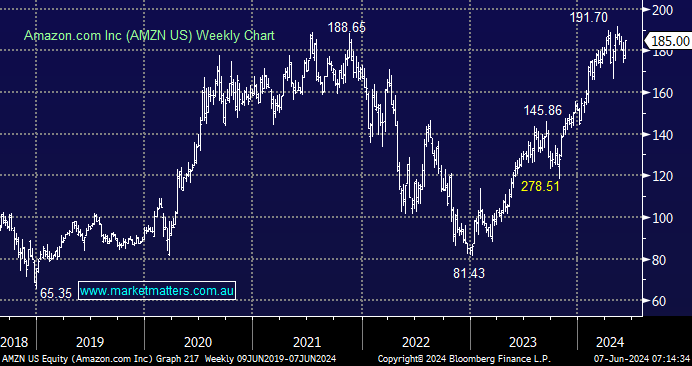

- We like AMZN from a risk/reward perspective ~$US175.