MM is looking to reduce our exposure to tech through 2022 with timing and stock selection an important combination. In the short-term we believe the sectors positioned to bounce strongly and even make fresh highs in some cases assisted by comments by the Fed last night and at the very least diminishing upside momentum by bond yields over the coming months.

Software design business ALU clearly looked after MM through 2021 while much of the Australian Tech Sector fell away as they failed to justify their lofty optimistic valuations. The company has shifted an increasing number of its customers to its cloud offering Altium 365 i.e. at its December AGM it reported 17,300 active users up from 12,800 in August which amounts to around 15% of its total sales on the cloud, we really like this evolution moving forward. Also post COVID the demand for PCB design (printed circuit board) looks poised to grow with the exponential take up of smart technology a huge growth driver.

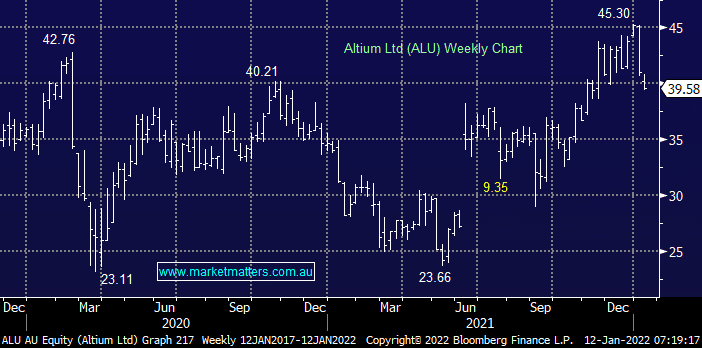

It would be easy to grab a near 50% profit in ALU but this remains one of our preferred Australian tech stocks / holdings at this stage even if it has shown an ability to correct well over 10% when the sector rolls out of favour. Quality stocks like cream trend to float to the top hence this is one we are likely to only consider selling into decent strength.