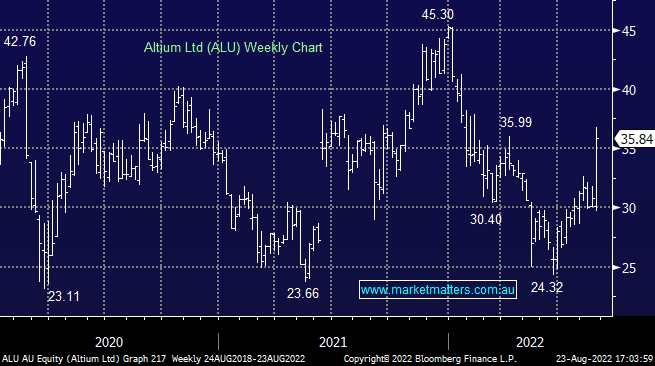

ALU +19.75%: The Printed Circuit Board (PCB) design platform reported FY22 results after market yesterday and they were above our expectations. Revenue delivered at $221m (+3% ahead) and EBITDA $81.1m (+8% ahead) while their FY23 guidance is also +8% better than consensus. They have a longer-term revenue target for $500m by FY26 and yesterday they said that the target is now on an organic basis versus the prior assumption that was supported by a 10-20% boost from acquisitions, so while M&A is still in play, that would add to that target – in other words, a further upgrade by stealth is the way we would describe it. The rest of the result was very solid, margins expanding and the broader trends here are good and growing – this is the best result we’ve seen in this period so far, plus they implied that guidance was conservative.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

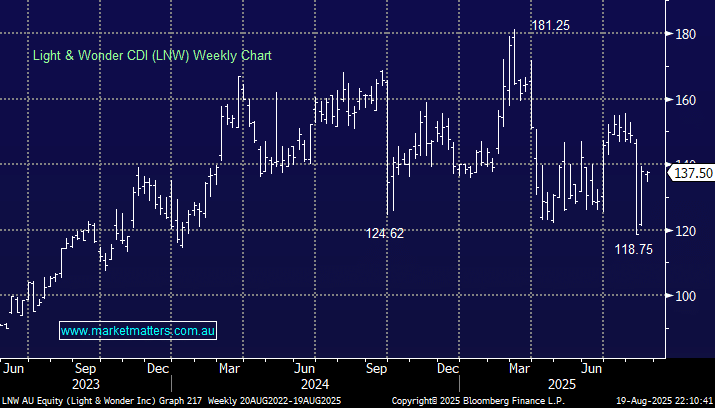

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Close

Close

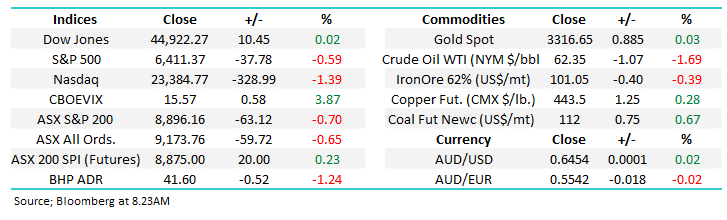

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Close

Close

MM remains long and bullish ALU

Add To Hit List

Related Q&A

Is Wistech (WTC) a Hitlist candidate?

Best way to play the Tech stock rally

Does MM prefer HUB24 or Altium?

What’s MM’s favourite 5 stocks for short term bull run?

Thoughts on ALU, MNS & IMU?

MM’s thoughts on ALU and TMH?

Does MM like Australian technology companies?

ALU, CDA, & 3 US-listed stocks BNTX, ZM, GOOS

Thoughts on ALU & APT

Altium smells fishy

MM view on ALU

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 20th August – ASX +44pts, JHX, MFG, APA

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 20th August – Dow up 10pts, SPI up +20pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.