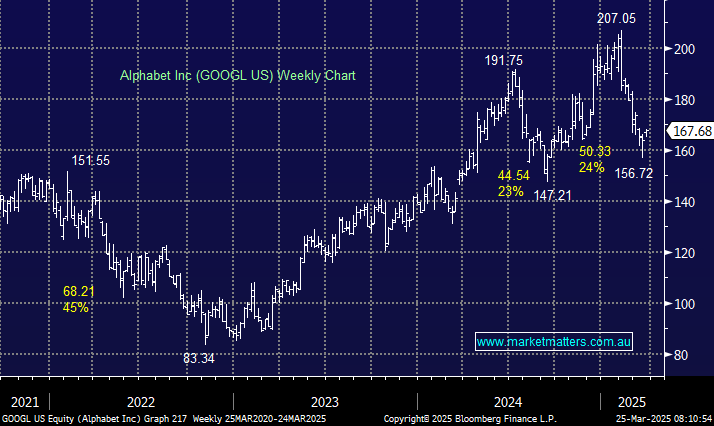

Alphabet has corrected ~24% from the $US200 area, in line with a weaker performance across the AI space, which has led to the correction in Big Tech. The Google parent company posted a cloud revenue miss in February as it ramps up spending on artificial intelligence (AI), worrying investors that the mega-cap technology company may fall short of its aspirations in the AI space.

However, we believe the sell-off is now overdone, with operating income up more than 30% year-on-year. However, for now, AI sentiment is driving the share price as it will play a significant role in the Goliath’s future growth, but we believe the weak longs have been washed out of this crowded space, and value is presenting itself to this quality business.

- We like GOOGL from a risk/reward perspective below $US170: MM owns GOOGL in its International Equities Portfolio.