There are two major structural themes playing our globally; the energy transition and explosion in Artificial Intelligence (AI). Copper is central to both. Global demand is expected to rise from ~28.5 Mt in 2024 to 50 Mt by 2050, a 70% increase from current levels. At the same time, global ore grades are declining and the average lead time for new copper miners has continued to blow out. This is a well-known theme, and one that BHP has highlighted several times as they work to increase their exposure to the base metal with the ~$10bn acquisition of Oz Minerals in 2023, and more recently, an unsuccessful ~$80bn bid for Anglo American. Many believe that Copper is now more important that Oil.

AIC Mines is an established, pure-play copper producer with a strong operational track record and a clear growth pathway. The company’s flagship Eloise mine has delivered nine consecutive quarters of production guidance, a rare achievement among ASX junior miners, implying good operational execution. This consistency provides us with confidence in AIC’s ability to execute its growth strategy.

At their September quarterly, Eloise, located in Northwest QLD, produced 3,324t Cu and 1,722oz of Gold at an all-in-sustaining cost (AISC) of A$4.97/lb, generating $27.1m in operating cashflow. Their FY26 guidance of 12.8–13.1kt Cu and 6–6.5koz Au at AISC $4.85–$5.25/lb, which, if achieved, will continue to drive strong free cash flow generation, underpinned by heavy investment over the past two years in its mining fleet and development of additional ore sources. They have good exploration prospects, along with a fully funded plant expansion at Eloise, targeting 20ktpa Cu by FY28.

- With $67.8m cash, an undrawn US$40m debt facility, and a recent equity raise completed, expansion and development projects are fully funded.

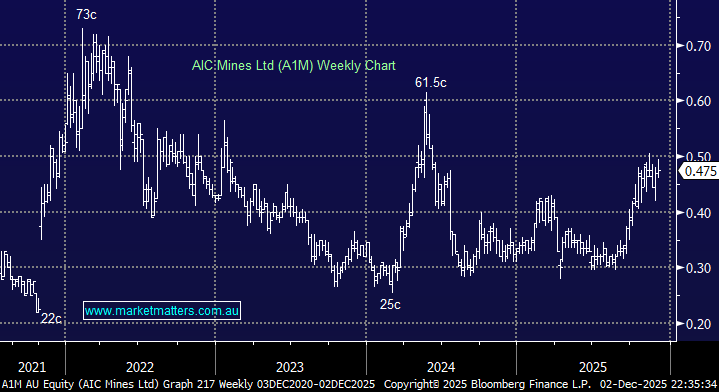

Despite a recent rally in the share price, AIM sits today with a market cap of just $380m and is down ~40% over the past 5 years, compared to Australia’s largest pure play exposure, Sandfire (SFR), which has rallied 4x over the same time frame. There are reasons for the performance differential, though what comes next is our primary focus.

Demand drivers are strong, production is increasing, and cash flows will continue to grow. While junior miners are inherently volatile, we think AIC Mines (AIC) has put in the foundations for strong performance over the coming years, with a management team that has demonstrated good execution.

- We are bullish on Copper, and A1M provides good (high-risk) leverage to the theme.