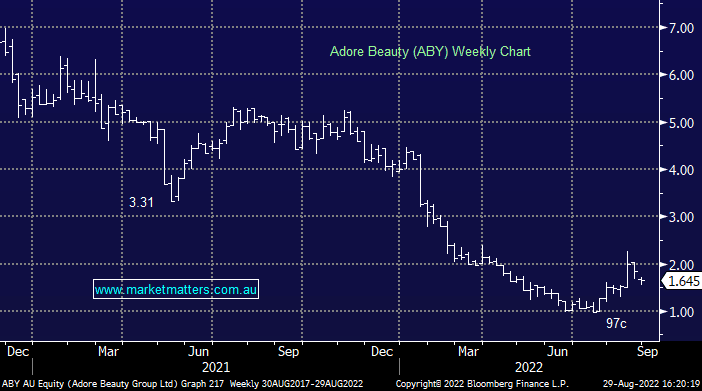

ABY -10.60%: the beauty products e-commerce business reported disappointing numbers and a softer outlook, weighing on the stock today. Revenue was a small miss to expectations despite being up +65% for the year, coming in at $199.7m. EBITDA at $5.3m was marginally below the consensus estimate as well, though EBTIDA margins were in line. FY23 expectations will have to be revised lower with the company saying sales are running at -28% on the same period last year in the first 7 weeks. While this number will normalize given it is cycling the boost from COVID lockdowns, the company doesn’t expect to see double-digit growth until the second half. Disappointingly, margins are expected to drop below the 2-4% in FY23, though they provided medium-term guidance of 8-10%for FY27, which highlights the benefit of increasing scale and growing the private label offerings.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is neutral ABY – today’s result was weaker than we hoped

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.