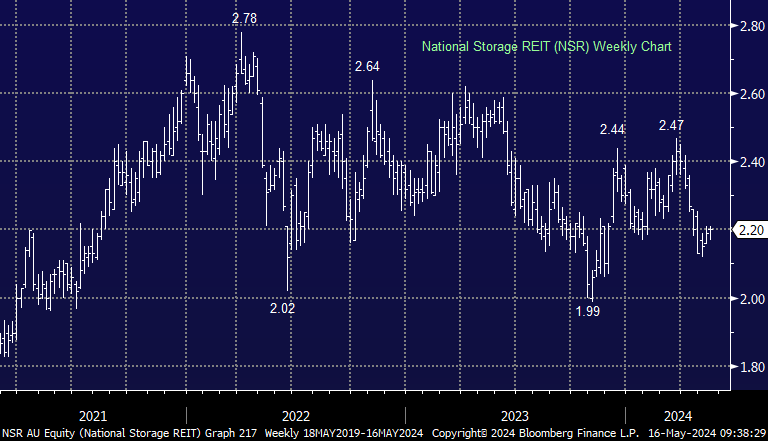

We believe National Storage (NSR) now looks relatively more attractive than Dexus (DXS) as a consequence of recent relative performance. While we have been defenders of the ‘office trade’ for some time and still view DXS as undervalued, we are more confident in the near-term outlook for NSR.

We are increasing our weighting towards property by moving to 5% in NSR (from 4% in DXS). We believe the risk/reward in NSR is compelling, despite its 5.15% yield being lower than DXS at 7.4%.