We are cutting our 4% position in ResMed (RMD) for a loss, seeing further risk market sentiment will struggle in the stock on the back of recent GLP-1 drug data. We are switching our healthcare exposure in the Active Growth Portfolio.

We are buying CSL as our switch in the Healthcare space. CSL remains a quality stock and we see an opportunity to move u the “quality” curve in the sector, taking an initial 4% position in the portfolio.

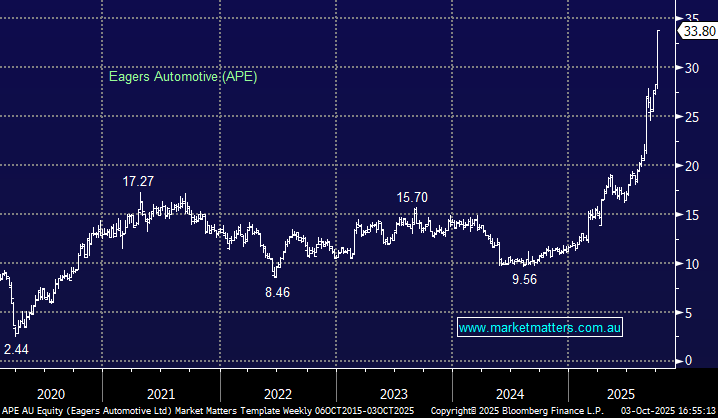

We are taking a 4% position in CAR Group (CAR) as we look to deploy cash into weakness. The online auto-classified business has pulled back into our buy zone.