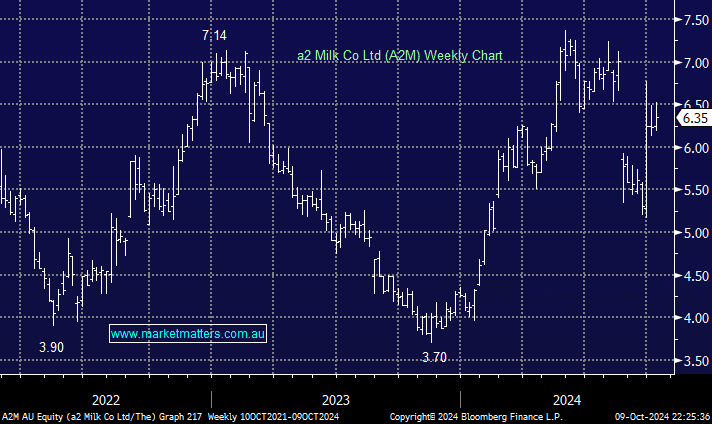

Auckland-based A2M has been volatile over recent years, but it’s generally impressed in 2024, advancing +49% year-to-date. However, the stock fell over 20% in August after disappointing the market with its FY24 result, but China’s stimulus rekindled the market’s appetite for the stock with over 60% of revenue comes from the world 2nd largest economy – the surge three weeks ago even drew a price query from the ASX. August’s correction by A2M was courtesy of an FY24 earnings miss (higher operating costs), an underwhelming FY25 revenue growth/margin guidance, and future supply chain challenges, but a rejuvenated China may force the market to look through some of these issues.

- We believe further Chinese stimulus will be released before Christmas, but A2M isn’t our preferred way to play the theme.