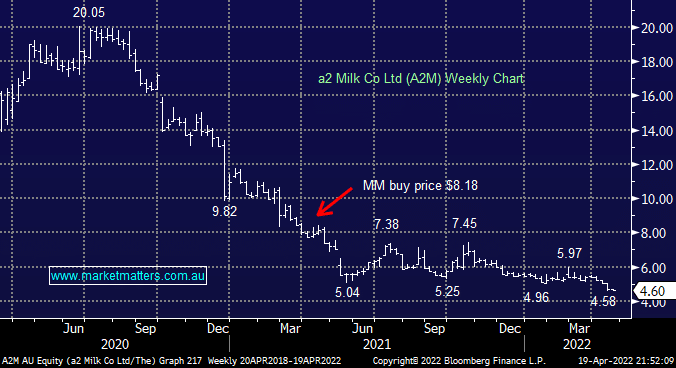

Rising COVID-19 cases in China and the administration’s focus on zero-tolerance are likely to be the final nails for our position in A2 Milk (A2M). While their last update in February was a positive one providing evidence that new management had a solid handle on the business, the turnaround discussed at the time underpinning a return to revenue growth in FY22 is now likely to be delayed, in MM’s view. While we can see a more positive story in outer years if they execute well, we’re losing patience in our position which has continued to decline. We see a better opportunity for recovery with lower risk in Treasury Wine Estates (TWE) which has also been hit by China-related factors.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 11th July – Dow up +192pts, SPI up +27pts

Friday 11th July – Dow up +192pts, SPI up +27pts

Close

Close

MM is considering cutting A2M for a loss, switching the funds into TWE

Add To Hit List

Related Q&A

Thoughts on a2 Milk (A2M) and National Storage (NSR)

Thoughts on A2Milk & Mesoblast

A2M, HUH, NVX, APX

MM’s view on PointsBet (PBH) & a2 Milk (A2M)

Is A2M a buy again?

Reviewing some “losers”

Stocks to lighten as I increase cash

What stocks would we top up here?

Making the tough decision to sell

Question on EVN & A2M

Muted class action on A2M

Tax loss selling in A2 Milk (A2M)

MM thoughts on A2 Milk (A2M) & EML Payments (EML)

What’s our plan with A2 Milk (A2M)

Thoughts on funeral operator IVC, WPL & A2M

Should we just cut A2M?

ALL, CTD, CGC, A2M

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 11th July – Dow up +192pts, SPI up +27pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.